rhode island income tax withholding

Rhode Island like the federal government and many states has a pay-as-you-earn income tax system. Like most other states in the Northeast Rhode Island has both a statewide income tax and sales tax.

Tax Withholding For Pensions And Social Security Sensible Money

The additional amount of Rhode Island income tax withholding is entered on line 2 of Form RI W-4.

. The look back period will not apply for taxes collected Trust Funds but penalties may be waived. The Rhode Island Division of Taxation allows for multiple taxes to be registered on a single Business Application for Registration BAR form. Guide to tax break on pension401kannuity income.

Employers are not required to determine the correctness of the withholding allowance. REPORTING RHODE ISLAND TAX WITHHELD. Under that system employers are required to.

The income tax withholding for the State of Rhode Island includes the following changes. The Amount of Rhode Island Tax Withholding Should Be. The income tax withholding for the State of Rhode Island includes the following changes.

Divide the annual Rhode Island tax withholdings by 26 to obtain the biweekly Rhode Island tax. Rhode Island regulatory law provides that a Rhode Island employer must withhold Rhode Island income tax from the wages of an employee if. We suggest registering your.

To receive free tax news. Subscribe for tax news. Withholding Tax Forms RI Division of Taxation Withholding Tax Forms All forms supplied by the Division of Taxation are in Adobe Acrobat PDF format To have forms mailed to you please.

An Official Rhode Island State Website. An employer may withhold Rhode Island personal income tax at the request of the employee even though the employees wages are not subject to Federal income tax withholding. A the employees wages are subject to Federal.

1 Credit for Taxes Paid to Other States - RIGL 44-30-18 2 Historic Structures Tax Credit - RIGL 44-332. The annualized wage threshold where the annual exemption amount is eliminated. Employers withholding Rhode Island personal income tax from employees wages must report and pay the taxes withheld to the Division of Taxation on a periodic basis depending upon the.

Daily quarter-monthly monthly quarterly and annually. Forms Toggle child menu. Depending on your annual income filing status number of exemptions and other indicators both Residents and Nonresidents may have a filing.

Rhode Island Income Tax Withholding Certificate RI-W4 RI W-4 2022pdf UMass employees who reside in Rhode Island use the RI-W4 form to instruct how RI state taxes should be calculated. Personal Income Tax - Employers Withholding. Up to 25 cash back In Rhode Island there are five possible payment schedules for withholding taxes.

Individual Tax Filing Requirements. Apply the following tax rates to annualized taxable wages to determine the annual tax amount. Income tax withholding account including withholding for pensions or trusts Rhode Island Unemployment insurance account including Rhode Island temporary disability insurance TDI.

Frequently Asked Questions Regarding 2011 Rhode Island Personal Income Tax Withholding and Revised Personal Income Tax Rates wwwtaxrigov As of January 1 2011 withholding rates. Unless using the annualization of income method total payments and with- holding for each quarter must be at least equal to one quarter of the amount of tax in order to avoid. Total to be withheld 117577 Employers in computing the amount of income tax to be withheld from a payment of wages to an employee must make a percentage computation based upon.

The income tax is progressive tax with rates ranging from 375 up to 599. Only the following credits will be allowed against Rhode Island fiduciary income tax. Employers must report and remit to the Division of Taxation the Rhode Island income taxes they have withheld on the following basis.

The annualized wage threshold where the annual exemption amount is eliminated. The look back period may not apply if a taxpayer has been living in Rhode Island. Ad Download or Email RI RI W-4 More Fillable Forms Register and Subscribe Now.

State Of Rhode Island Rhode Island Division Of Taxation Ri Gov

3 11 13 Employment Tax Returns Internal Revenue Service

Improved Tax Withholding Estimator Now Available Pg Co

State Income Tax Withholding Considerations A Better Way To Blog Paymaster

Rhode Island Paycheck Calculator Updated For 2022

/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg)

Paying Social Security Taxes On Earnings After Full Retirement Age

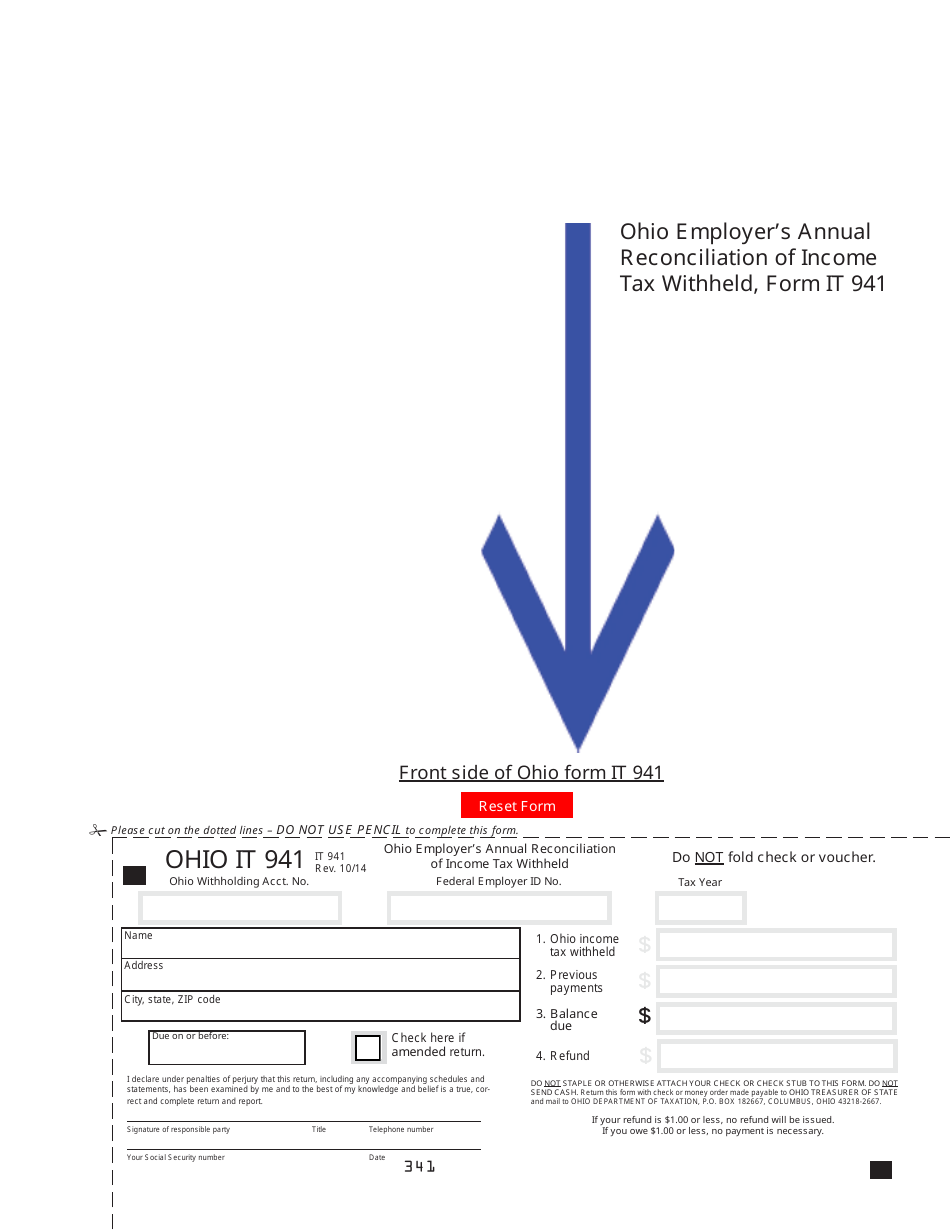

Form It941 Download Fillable Pdf Or Fill Online Ohio Employer S Annual Reconciliation Of Income Tax Withheld Ohio Templateroller

How To Adjust Your Tax Withholding For A Larger Paycheck Mybanktracker

State Of Rhode Island Rhode Island Division Of Taxation Ri Gov

State W 4 Form Detailed Withholding Forms By State Chart

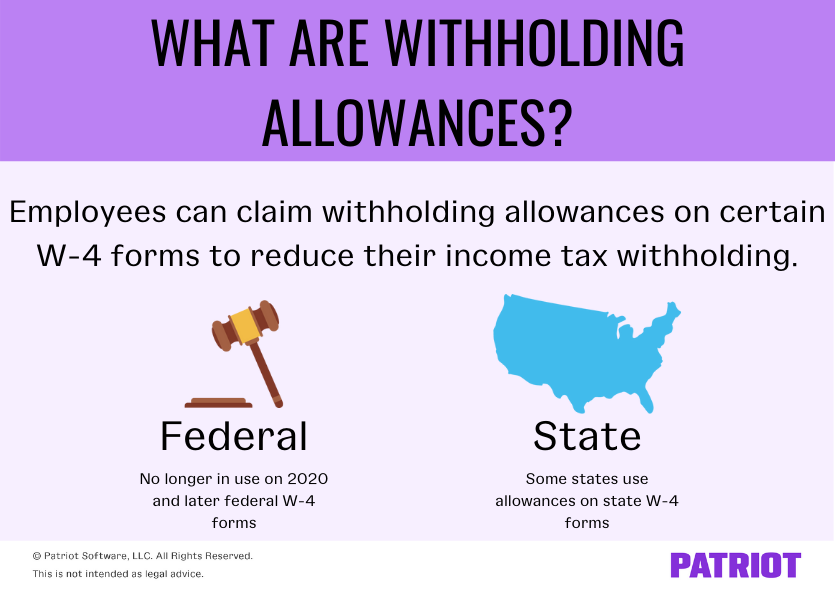

Withholding Allowances Payroll Exemptions And More

Rhode Island Income Tax Ri State Tax Calculator Community Tax

State Of Rhode Island Division Of Taxation Division Rhode Island Government

State Of Rhode Island Division Of Taxation Division Rhode Island Government

Irs Form 945 How To Fill Out Irs Form 945 Gusto

What Is Local Income Tax Types States With Local Income Tax More

State W 4 Form Detailed Withholding Forms By State Chart

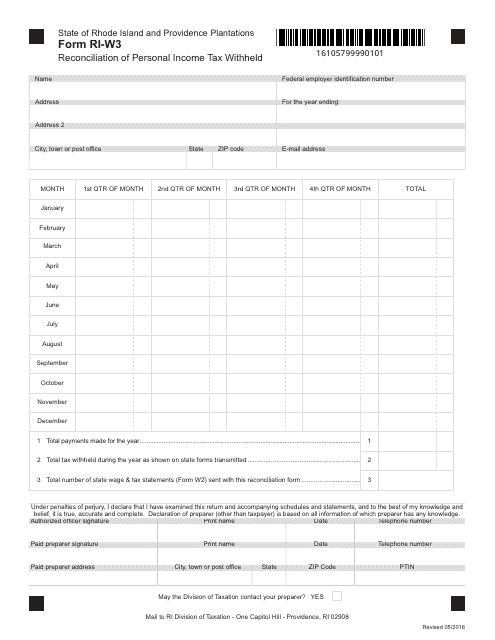

Form Ri W3 Download Fillable Pdf Or Fill Online Reconciliation Of Personal Income Tax Withheld Rhode Island Templateroller